unified estate tax credit 2021

The exclusion amount in. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax.

U S Estate Tax For Canadians Manulife Investment Management

Under the tax reform law the increase is only temporary.

. Any tax due is. For 2021 the estate and gift tax exemption stands at 117 million per person. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

So individuals can pass 117 million to their heirsand couples can transfer twice that amountwithout paying a. Taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use. The basic exclusion amount for determining the unified credit against the estate tax will be 11700000 up from 11580000 for decedents dying in calendar year 2021.

Wednesday January 20 2021 The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million. Estate tax return may still be required even if the value of the decedents US. The amount of the estate tax exemption for 2022 For 2022 the personal federal estate tax exemption amount is 1206 million it was 117 million for 2021.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. The unified tax credit is a term encompassing two or more tax exemptions that taxpayers can use in combination to transfer substantial amounts of assets to heirs without triggering the need to. Credit Cards Featured Offerings.

Or of course you can use the unified tax credit to do a little bit of both. 2021-03-15 For 2009 tax returns every American received. No California estate tax means you get to keep more of your inheritance.

This is called the unified credit After the unified credit limit is reached the donor pays up to 40 percent on. The unified credit is per person but a married couple can combine their exemptions. The last 2021 tax law change you need to know about is the capital gains tax.

The extent of the benefit. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. For 2021 that lifetime exemption amount is 117 million.

Federal Minimum Filing Requirement. Those lifetime figures are drawn from the estate tax exemption since the. Numbers for Life Insurance and Estate Planning Unified Credit Against Estate Tax To 11y million for a decedent dying in 2021 from 1158 million for a decedent dying in 2020.

A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. Assets to the total worldwide estate. California does not levy a gift tax.

The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021. The Estate Tax is a tax on your right to transfer property at your death. The 2021 federal tax law applies the estate tax to any amount above 117 million.

This also includes GSTT gifts generation-skipping transfer tax gifts which are gifts to those more. For people who pass away in 2022 the. Unified credit against estate tax 2021.

What Is the Unified Tax Credit Amount for 2021. However the federal gift tax does still apply to residents of California. Estate tax unified credit for 2021.

Estate tax returns are required when the total gross value of the estate exceeds the amount shown in the following table. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount. Capital gains taxes may change in two.

How the Unified Tax Credit Helps Taxpayers in 2021 The big perk of the unified credit is that it allows you to reduce your annual taxable income each year while giving those. Gifts and estate transfers that exceed 1206 million are subject to tax. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically decrease the Unified Credit for Estate taxes from.

The capital gains tax is a tax on investments that have increased in value. Overview Thematic Investing. This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples.

As of 2021 married couples can exempt 234 million In 2022 couples can exempt 2412 million. The unified tax credit changes regularly depending on regulations related to estate and gift taxes. This of course could remain subject to change.

For purposes of completing a federal estate tax return Form 706 or gift tax return Form 709 the BEA is converted into a tax credit amount known as the Applicable Credit. The gift and estate tax exemptions were doubled in.

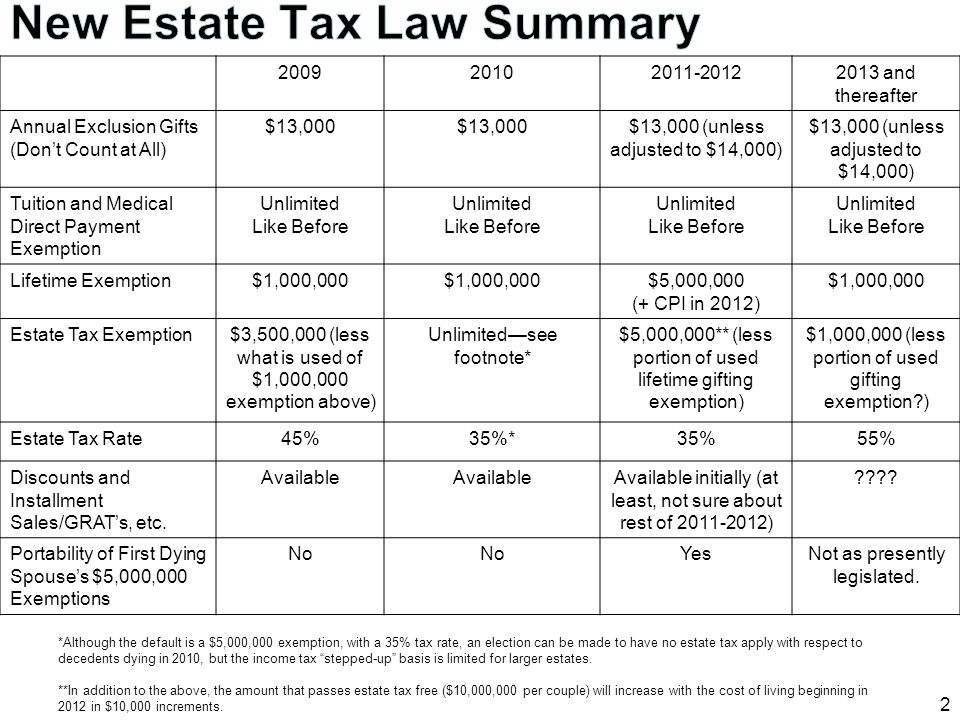

How To Advise Your Clients Under The New Estate Tax Law Ppt Download

Historical Estate Tax Exemption Amounts And Tax Rates 2022

U S Estate Tax For Canadians Manulife Investment Management

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

U S Estate Tax For Canadians Manulife Investment Management

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Estate Tax In The United States Wikiwand

Exploring The Estate Tax Part 2 Journal Of Accountancy

What Is New York S Estate Tax Cliff 2021 Round Table Wealth

A Guide To Estate Taxes Mass Gov

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

How To Avoid Estate Taxes With A Trust

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

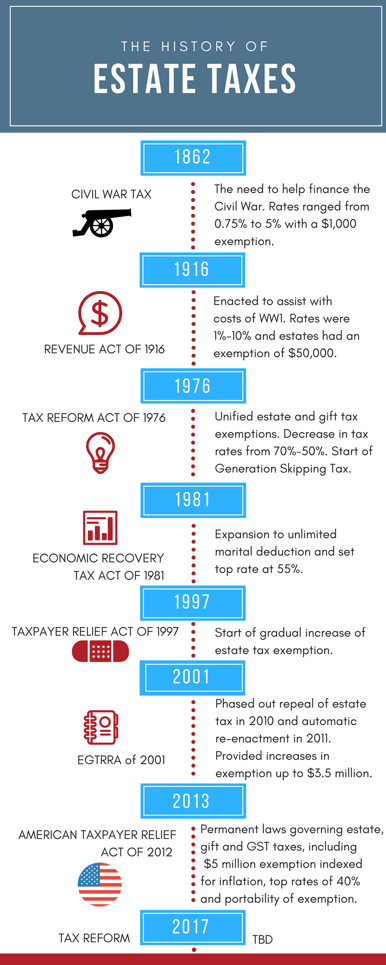

A Brief History Of Estate Gift Taxes

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

What Happened To The Expected Year End Estate Tax Changes

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services